open ended investment company vs unit trust

They are often set up in series. Guide to Investment Trusts.

What Are Open Ended Mutual Funds Mutuals Funds Mutual Funds Investing Bond Funds

Exchange traded funds are growing in popularity and are covered.

. You can generally choose to have dividends paid to you as income or reinvested in the fund. OEICs vs Unit Trusts. Both are sometimes referred to as being open-ended.

Between mid-May 2008 and March 2009 the unit trust outperformed the investment trust by 24 per cent -. Exchange-traded funds ETFs are generally structured as open-end funds but can also be structured as UITs. Many mutual funds are open-ended.

Housebuilders strength is good for services firm Nexus. Units in a unit trust and shares in a company. The trust deed is.

Mutual funds and unit trusts are forms of open-ended investment. In 2018 a new fund structure named open-ended fund company OFC was introduced under the Securities and Futures Ordinance to provide a corporate fund structure in addition to the existing available unit trust structure for investment funds domiciled in Hong Kong. Investment trusts are closed-ended funds because they issue a fixed number of non-redeemable shares for investment.

Open-ended investment companies OEICs introduced in 1997 are governed under company law. UITs are trust funds with a set number of shares and end dates. Positive trends and potential put spotlight on UDG.

The term investment company refers to a company that pools investors money to purchase a group of stocks bonds and other securities. Most of the household name mutual fund companies such as American Funds American Century Pioneer Davis TIAA-CREF AIM Putnam Franklin and. Investors buy and sell shares by trading amongst themselves on a recognised stock exchange in a similar way to a standard company share.

Ad Life Is For Living. Other examples of investment companies are mutual funds and. In many ways unit trusts and OEICs are the same.

The open-end fund is by far the most common type of mutual fund available. However they do have key legal and tax differences which will affect your decision as to which structure is best for you. One confusing thing is that the term unit trust technically refers to those open-ended funds that use dual.

Find a Dedicated Financial Advisor Now. They are priced differently with ETFs fluctuating throughout the day like stocks and mutual funds changing once a day. How Unit Trusts Work.

Open-end funds are investment companies that are able to buy and sell an unlimited number of shares. A unit investment trust UIT is one of three basic types of investment companiesThe other two types are open-end funds usually mutual funds and closed-end funds. Two of the most popular types of fund are unit trusts and open-ended investment companies OEICs.

Lets Partner Through All Of It. There are significant differences in the structure pricing and sales of closed-end funds and open-end funds. Staying focused amid market noise is key to Bankers success.

Do Your Investments Align with Your Goals. The new OFC regime came into effect on 30 July 2018. For example they both allow participants to have a proportionate interest in the structure.

On the face of it unit trusts and companies may seem like similar structures. Unit investment trusts UITs and mutual funds are both baskets of stocks bonds and other securities that pool investors finances. Time to pounce on Cairn while the shares are cheap.

Both can generally invest across a wide range of asset classes geographies and sectors. The trustee a shelf company is set up to act for the unit trust. A UIT invests the money raised from many investors in its one-time public offering in a generally.

The aftermath of the EU referendum on the 24 June last year ended up highlighting one of the main differences between open-ended and closed-ended funds. Unit trusts are open-ended which means investors can make continued contributions to it as well as withdrawals from it. Unit trusts and Open Ended Investment Companies OEICs are collective investment schemes where investors purchase units or shares in a pooled fund which is run by an investment manager.

They are open-ended and the price of each unit unit trust or share OEIC depends on the net asset value NAV of the funds investment portfolio. A closed-end fund has a fixed number of shares offered by an investment company. Both fund vehicles can invest in a wide range of asset.

They are open-ended and the price of each unit unit trust or share OEIC depends on the net asset value NAV of the funds investment portfolio. Mutual funds are open-ended and actively managed with shares being offered to the public. Open-ended funds used to have a bid and offer price too but most have now converted to a new kind of legal structure called an open-ended investment company OEIC which just has a single price whether you are buying or selling.

Exchange-traded funds and open-ended mutual funds are similar in the sense that each share represents a slice of all the funds underlying investments. Unit trusts and OEICs have plenty in common in that they are both open-ended and the price of each unit unit trust or share OEIC depends on the net asset value of the funds investment portfolio. A unit trust is an investment usually good for beginning investors that is similar to but not the same as a mutual fund.

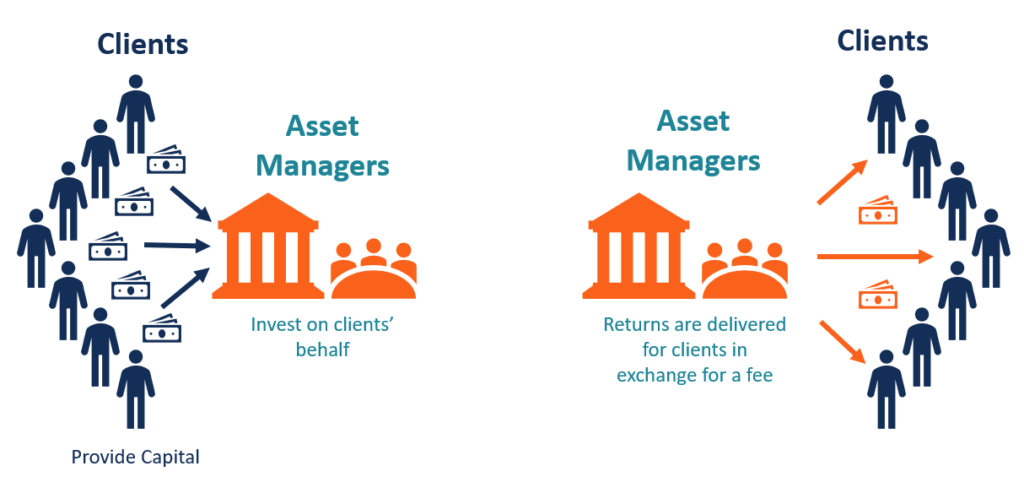

Investment funds known as mutual funds in the US are collective investment schemes which pool your money with that of other investors to give you a stake in a ready-made portfolio. Find A Dedicated Financial Advisor. Mutual funds can only be traded at the end of the day while ETFs are.

A unit investment trust is a type of investment that offers a fixed portfolio of securities to an investor.

There Is A Common Misconception About Mutualfund Investment That Once Invested The Money Gets Locked In For A Long Time Howev Mutuals Funds Facts Investing

Investment Banking Company In Usa 1 914 318 9427 Investment Banking Investing Investment Companies

Types Of Mutual Funds Investing Mutuals Funds Safe Investments

Mutual Fund Classification Mutuals Funds Finance Investing Fund

Etf V S Open Ended Fund And Close Ended Fund Financial Management Stock Market Latest Business News

Understanding Closed End Vs Open End Funds What S The Difference

Differences Between Closed End Open End Mutual Funds Mutuals Funds Mutual Funds Investing Fund

Open Ended Vs Closed Ended Funds Stock Market Fund Management How To Raise Money

Understanding Of Open Ended Funds Fund Management Systematic Investment Plan Market Risk

Difference Types Of Mutual Funds Investing Mutuals Funds Dividend

Do You Know The Difference Between Etfs And Mutual Funds Investing Mutuals Funds Real Estate Investment Trust

This Pin Gives A Brief Idea On What Is Mutual Funds And Types Of Schemes Read The Full Article Below Http Blog El Mutuals Funds Investing Finance Investing

Asset Management Company Amc Overview Types Benefits

What Is A Close Ended Funds A Close Ended Fund Also Called Closed End Investment And Closed End Mutual Fund It Is A Type O Finance Blog Mutuals Funds Fund

Best Large Cap Mutual Fund In India Ideal For Long Term Investment I Mutual Fund India Mutuals Funds Mutual Funds Investing

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)